Table of Contents Show

The U.S. Office of the Comptroller of the Currency (OCC) has issued a historic statement: United States banks can now hold cryptocurrency. This move opens the door for traditional financial institutions to incorporate digital assets into their offerings, which could lead to increased adoption and mainstream acceptance of the crypto space.

A Major Shift in Banking and Crypto

Traditionally, cryptocurrencies have been avoided by banks out of regulatory risk and security fears. The move by the OCC, though, marks a sea change in how digital assets are viewed by the financial community. By enabling banks to custody cryptocurrencies on behalf of their customers, institutions can now provide secure storage options for investors who are afraid of handling private keys and wallets themselves.

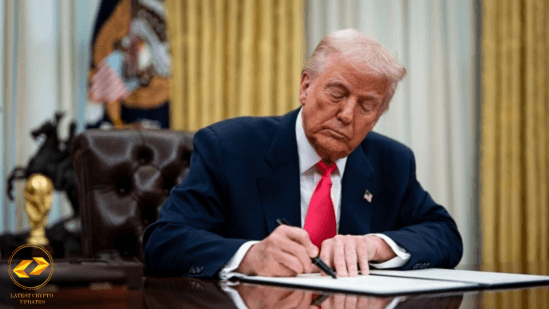

Trump’s Support for Crypto Firms

The move comes in line with remarks made at a recent crypto summit, in which former US President Donald Trump expressed his agreement with the stopping of debanking crypto firms. Several crypto firms have struggled to hold onto banking relationships as a result of regulatory issues and perceived threats. The environment for crypto firms may be much better under this new decision, as banks will be less likely to fear providing services over the threat of regulatory action.

The Future of Banking and Digital Assets

The harmonization of cryptocurrency custody service with the conventional banking environment is likely to usher a new set of opportunities and issues. While it has the potential to increase consumer confidence in virtual assets, which can make them more appealing to mass investors, banks will be required to have stringent security practices in place to prevent hacks and cyber attacks.

Moreover, regulatory certainty will be paramount in deciding how banks navigate compliance complexities, anti-money laundering (AML) regulations, and customer protection. The OCC’s action is merely one step in a larger trend toward regulatory acceptance of cryptocurrencies within the U.S. financial system.

The OCC’s permission of U.S. banks to hold cryptocurrency marks a historic breakthrough for the banking and crypto sectors. As traditional financial institutions accept digital assets, we can expect higher adoption, enhanced security, and a stronger infrastructure for the crypto economy. With policymakers such as Trump pushing for increased financial inclusion of crypto firms, the prospects for digital assets in the U.S. are rapidly looking brighter.

Stay Updated With the Latest Crypto News

For the latest updates, stay connected with us!

👉 Connect with us on LinkedIn: Latest Crypto Update

👉 Follow us on Instagram: Latest Crypto Update

👉 Follow us on Twitter: LCU on Twitter

👉 Subscribe to Our Newsletter for the latest crypto news and market insights.

Disclaimer:

The information provided on this website is for informational purposes only and may include third-party opinions or sponsored content. We do not offer financial advice. Before engaging with any exchange or individual, please conduct your own research and make decisions responsibly. For more details, review our Terms & Conditions.