Table of Contents Show

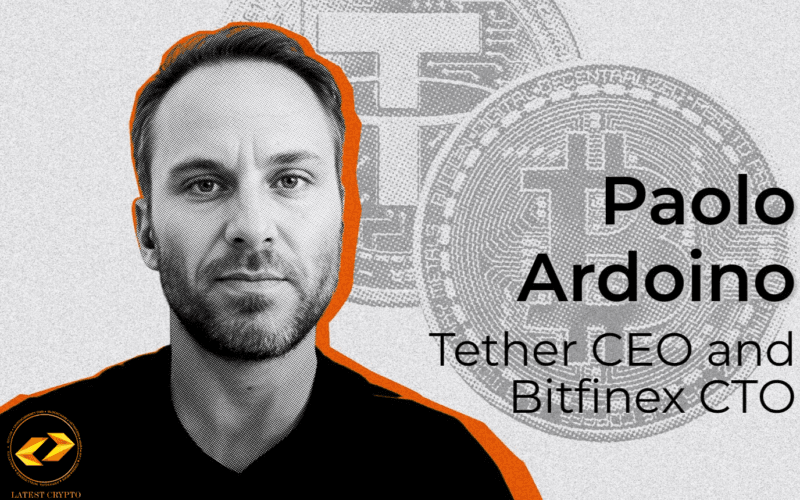

In the fast-changing environment of digital finance, stablecoins have been crucial tools, providing a sense of stability in the midst of volatility that is intrinsic to cryptocurrencies. Of them, Tether’s USDT is one, not just by virtue of its market leadership but also by virtue of the vision expressed by Paolo Ardoino, the CEO of Tether. According to Ardoino, USDT is an intermediate phase to a world in which Bitcoin will be the world financial standard, making stablecoins such as USDT redundant.

USDT: The Transitional Tool

USDT was created to fill the gap between fiat currencies and cryptocurrencies, offering a stable currency that is pegged to the U.S. dollar. The stability has made it a favorite among traders and investors looking to hedge against the risks of crypto market volatility. Ardoino, however, sees this function as temporary. According to him, as the world financial system shifts towards Bitcoin, the need for a dollar-pegged stablecoin will become less necessary.

The Inevitable Shift to Bitcoin

Ardoino’s confidence in Bitcoin’s rise is founded on his perception of the present monetary system’s vulnerability. He proposes that vulnerabilities within the system might cause a breakdown, making Bitcoin a stronger substitute with its decentralized model and finite supply. Here, Bitcoin would not simply exist alongside legacy currencies but replace them, setting a new standard for value and exchange.

Implications for the Financial Ecosystem

The shift Ardoino outlines has significant implications:

For Stablecoins: With widespread Bitcoin adoption, the need for stablecoins such as USDT may diminish and, eventually, phase out.

For Financial Institutions: Banks and payment processors would have to adjust to a Bitcoin-dominated environment, rebuilding current infrastructures to support decentralized finance.

For Regulators: The introduction of a Bitcoin standard would require regulators to build new frameworks, coping with the monetary policy, tax, and financial regulatory issues.

Challenges and Considerations

The vision is tantalizing, yet numerous challenges remain:

Volatility: Volatility of the price of Bitcoin poses a substantial challenge for adoption as a steady means of exchange.

Scalability: The existing Bitcoin network has a scalability issue with regards to the capacity to handle high transaction numbers efficiently.

Regulatory Resistance: Governments might oppose the loss of control over monetary systems arising from a shift.

Paolo Ardoino’s vision provides an interesting insight into a possible future where Bitcoin is at the forefront of the world’s financial system. Although USDT is important now, helping to bridge traditional finance and the crypto space, its presence as a bridge implies a destination point ahead—a future where Bitcoin is the norm, and the bridges that helped bridge the old and the new are no longer necessary.

Stay Updated With the Latest Crypto News

For the latest updates, stay connected with us!

👉 Connect with us on LinkedIn: Latest Crypto Update

👉 Follow us on Instagram: Latest Crypto Update

👉 Follow us on Twitter: LCU on Twitter

👉 Subscribe to Our Newsletter for the latest crypto news and market insights.

Disclaimer:

The information provided on this website is for informational purposes only and may include third-party opinions or sponsored content. We do not offer financial advice. Before engaging with any exchange or individual, please conduct your own research and make decisions responsibly. For more details, review our Terms & Conditions.