Table of Contents Show

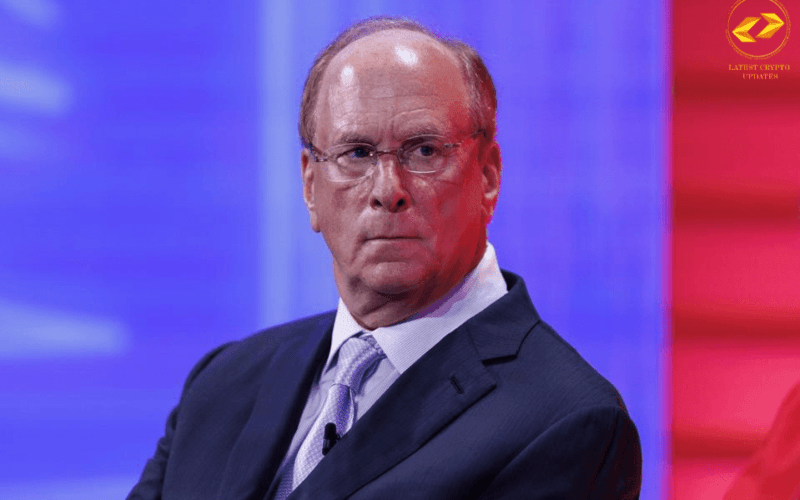

Inflation has been a recurring problem for the U.S. economy, and BlackRock CEO Larry Fink has warned that things could get worse in the next few months. Fink recently forecasted that inflation will increase in the next 6-9 months because of policies that Donald Trump will probably pursue if he wins the 2024 presidential elections.

His remarks have created shockwaves in financial markets, as investors prepare for possible economic changes. But what precisely is fueling this forecast? And how might increasing inflation affect major markets—including the crypto universe?

Let’s sort it all out.

Why BlackRock Expects Inflation to Increase

Larry Fink’s warning is based on the expected economic policies of a second Trump administration. Trump has indicated that he will try to enact deep tax cuts, increase infrastructure spending, and possibly impose new tariffs on imported goods. These actions could lead to inflation in a number of ways:

Tax Cuts and Government Spending

Trump has traditionally preferred tax cuts, especially for corporations and high-income individuals. Tax cuts have the ability to stimulate economic activity but also boost demand, which can raise prices.

If accompanied by forceful government spending—especially infrastructure spending—this would put more money into the economy, which could lead to inflationary pressures.

Tariffs and Trade Policy

Trump has signaled the imposition of new tariffs, especially on Chinese products. Higher tariffs tend to raise the cost of production for companies, which in turn will be passed on to consumers through higher prices.

Trade war-caused supply chain disruptions can also lead to inflation by increasing the cost of goods and making them more difficult to access.

Pressure on the Federal Reserve

When inflation begins to rise, the Federal Reserve might need to raise interest rates to brake the economy.

Increased interest rates increase the cost of borrowing money for companies and consumers, leading to reduced economic growth.

How Rising Inflation Might Affect the U.S. Economy

An inflation boom can have ripple effects on various segments of the economy. This is what will happen if Fink’s prediction materializes:

More Expensive Everyday Items: Consumers might see higher prices for basic needs like food, gasoline, and shelter.

Higher Interest Rates: The Fed could fight inflation with higher interest rates, increasing the cost of mortgages, credit card debt, and business loans.

Volatility of the Stock Market: Investors dislike inflation and overreact to such concerns, resulting in stock price fluctuations.

While a certain degree of inflation in a developing economy is healthy, a sudden hike can become expensive for consumers as well as corporations.

What Does This Mean for Crypto?

Cryptocurrency has, in many times of high inflation, been regarded as a secondary investment option. The effect of inflation on cryptocurrencies is, however, multifaceted and dependent on many different variables:

Bitcoin as an Inflation Hedge

Bitcoin is often referred to as “digital gold” based on its limited supply of 21 million coins. When inflation is high, some investors use Bitcoin as a hedge, just as they buy gold. If inflation does increase, as Fink forecasts, we would expect to see more interest from institutional investors in Bitcoin as a way to preserve their wealth.

Regulatory Uncertainty Under Trump

Trump has taken an uncertain approach to cryptocurrency regulation in the past.

A new Trump government may implement more rigid rules affecting crypto trading, taxation, or even mining activities in the United States.

Volatility in the Market

When inflation increases and the Fed reacts to it with aggressive rate hikes, crypto markets might experience sharp price fluctuations.

In the past, Bitcoin has performed poorly when monetary policy gets tight, as rising interest rates make traditional assets such as bonds increasingly appealing.

Preparing for the Future

With the uncertainty over the 2024 election and economic policies, investors need to take into consideration:

Diversifying their investment portfolios to shield against inflation risks and market fluctuations.

Keeping tabs on Federal Reserve policies to project possible rate hikes.

Being up to date with regulatory shifts that may affect crypto investments.

While Fink’s forecast is gloomy, it’s valuable to observe how economic policy really plays out. Inflation patterns, Federal Reserve actions, and international trade policies will all help dictate the economic landscape in the months ahead.

What’s your take? Will Trump’s policies push inflation up, or will the economy settle down? Let us know in the comments

Stay Updated With the Latest Crypto News

For the latest updates, stay connected with us!

👉 Connect with us on LinkedIn: Latest Crypto Update

👉 Follow us on Instagram: Latest Crypto Update

👉 Follow us on Twitter: LCU on Twitter

👉 Subscribe to Our Newsletter for the latest crypto news and market insights.

Disclaimer:

The information provided on this website is for informational purposes only and may include third-party opinions or sponsored content. We do not offer financial advice. Before engaging with any exchange or individual, please conduct your own research and make decisions responsibly. For more details, review our Terms & Conditions.