Table of Contents Show

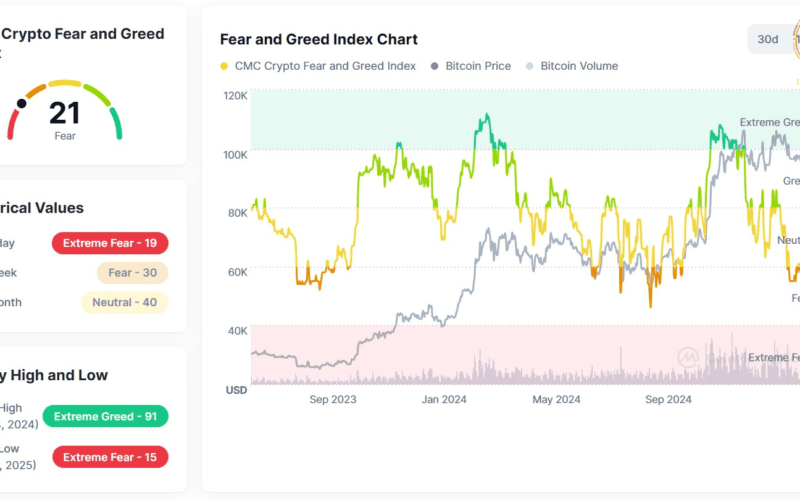

The Crypto Fear and Greed Index (FGI), a fundamental sentiment gauge, has dropped to 21, indicating “Extreme Fear.” This is a major decline from the previous month’s reading of 40, a sign of increased uncertainty and bearishness across the crypto market.

This downturn coincides with dramatic price declines for top cryptocurrencies, including Bitcoin, Ethereum, and altcoins experiencing severe losses. Nevertheless, there are opportunities among the fear, with Bitcoin ETFs reporting a $13 million influx.

Let’s deconstruct the main factors that drive this downtrend and what this means for investors in the future.

Knowing the Crypto Fear and Greed Index

The Fear and Greed Index tracks crypto market sentiment between 0 and 100:

0-24: Extreme Fear

25-49: Fear

50-74: Greed

75-100: Extreme Greed

A low reading like 21 indicates investors are extremely risk-averse, usually resulting in higher selling pressure. Historically, such extreme fear periods have occasionally been followed by market reversals, as shrewd investors capitalize on cheaper prices.

Current Market Overview: A Widespread Crypto Sell-Off

The recent FGI drop comes in line with a significant collapse throughout the crypto space:

Bitcoin’s Struggle

Market Cap: Down 15%, now at $1.65 trillion

Price Action: Bitcoin has lost a lot of its value, bringing it closer to significant support levels.

Ethereum’s Sharp Decline

Market Cap: Fell more than 30% to $227 billion

Price Movement: Ethereum has fallen more than Bitcoin, potentially due to fear of network congestion and declining staking rewards.

Altcoins in Freefall

Total Altcoin Market: Down 20%

Several altcoins are experiencing even more precipitous declines, as investors transfer funds into safer assets such as Bitcoin and stablecoins.

Stablecoins Holding Firm

Stablecoin Market Cap: Holding firm at $216 billion

The fact that stablecoin capitalization has not witnessed any significant fluctuation indicates that a lot of investors are remaining on the sidelines, holding back until market conditions improve.

Bitcoin ETFs See Inflows

Even as the overall sell-off intensified, Bitcoin ETFs experienced $13 million inflows, which suggests that institutional investors believe there is value at current prices.

Why Is the Market Falling?

There are a number of reasons why the market might be falling:

Macroeconomic Uncertainty: Fears of inflation, interest rate increases, and a strengthening dollar have rendered risk assets such as crypto less appealing.

Regulatory Pressure: Governments around the globe keep ratcheting up regulations, which instills fear in investors.

Market Liquidity Concerns: Reduced liquidity on exchanges has increased price fluctuations, and hence more volatility.

Investor Panic: Market sentiment, as the Fear and Greed Index indicates, is important—prices tend to come down under panic selling.Is This a Buying Opportunity?

Historically, Extreme Fear levels have tended to register local bottoms in the market. When FGI readings drop below 25, it tends to mean that selling pressure is exhausting, and a rebound may be imminent.

What to Watch For:

Bitcoin Support Levels: If BTC maintains critical support levels, it may signal a stabilization phase.

Institutional Activity: Ongoing Bitcoin ETF inflows may signal increasing confidence among institutional investors.

Macro Trends: A change in worldwide economic circumstances (i.e., rate reductions or better liquidity) may cause crypto prices to rise again.

Timing the market is always difficult, though. While the most extreme fear will offer up some great opportunities to buy, investors must do their own homework and look at long-term fundamentals before acting.

Final Thoughts

The Crypto Fear and Greed Index falling to 21 indicates general panic within the market, but history shows that fear-based sell-offs are sometimes blessing in disguise for patient investors.

Are Bitcoin and Ethereum due for a rebound soon, or is there more loss in store? Share your thoughts in the comments!

Stay Updated With the Latest Crypto News

For the latest updates, stay connected with us!

👉 Connect with us on LinkedIn: Latest Crypto Update

👉 Follow us on Instagram: Latest Crypto Update

👉 Follow us on Twitter: LCU on Twitter

👉 Subscribe to Our Newsletter for the latest crypto news and market insights.

Disclaimer:

The information provided on this website is for informational purposes only and may include third-party opinions or sponsored content. We do not offer financial advice. Before engaging with any exchange or individual, please conduct your own research and make decisions responsibly. For more details, review our Terms & Conditions.