Table of Contents Show

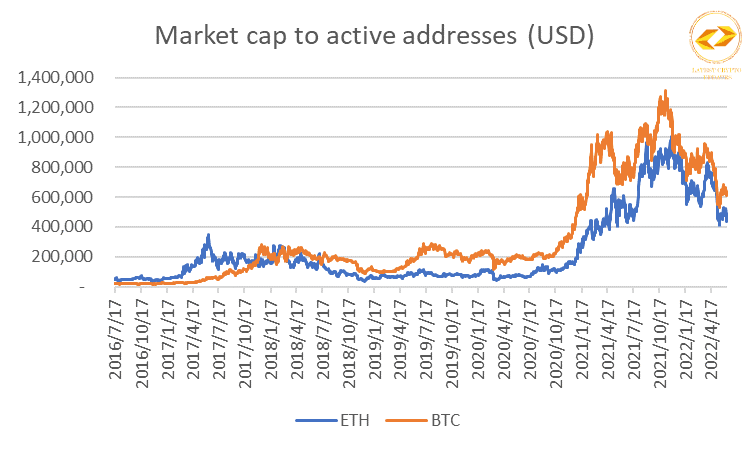

The second-largest cryptocurrency in terms of market capitalization, Ethereum, is experiencing a dramatic uptick in on-chain activity. In the last 24 hours alone, active addresses on the Ethereum blockchain have increased by 17%, from 429,000 to 503,000.

This sudden spike indicates increasing activity within the Ethereum network and questions the cause of this sudden surge. Let’s take a closer look at the possible reasons for this spike and what it could potentially mean for Ethereum’s future.

Understanding Active Addresses

Active addresses refer to accounts which have been engaged in transactions—sending or receiving ETH or simply accessing smart contracts—over some time. The growing number of active addresses would normally indicate increasing user activity, increased adoption, or a big network event.

Why Ethereum Active Addresses Are Surging

Various factors may be driving this fresh activity spike:

1. Rekindled Market Interest and ETH Price Action

Crypto markets usually see spikes in activity when there is price volatility or an uptrend. If the price of Ethereum has been on the rise, investors and traders may be shifting their funds, which would result in more active addresses.

2. Higher DeFi and NFT Activity

Ethereum has a massive DeFi ecosystem of decentralized finance applications and NFT marketplaces. An increase in DeFi lending, staking, or NFT trading may be making more users engage with Ethereum-based protocols, thereby driving active wallets higher.

3. Institutional and Retail Adoption

Large firms and institutional investors remain interested in Ethereum. When a large player has made a move—like implementing Ethereum for payment or introducing a new financial product—this may be part of the reason for the higher activity.

4. Ethereum’s Upgrades and Network Improvements

Ethereum has been undergoing significant upgrades to enhance scalability, transaction rate, and fees. With Ethereum 2.0 and Layer 2 scaling solutions such as Arbitrum and Optimism catching up, more people may be incentivized to interact with the network.

5. Speculation Surrounding Future Events

Crypto markets tend to be speculative. If there are any forthcoming Ethereum-related announcements—like an ETF listing approval, large partnership, or protocol update—this may be encouraging traders and investors to pull their ETH, causing more active addresses.

What This Means for Ethereum

Increasing active addresses tends to be a good indication of Ethereum’s network health. Here’s why it is important:

Increased adoption and usage: Higher active wallets are indicative of an increase in Ethereum users, crucial for long-term growth.

Likely price impact: Greater activity on the network tends to have a positive price impact on ETH due to rising demand.

Increased fundamentals: Unless this trend proves to be anomalous, this could be reflective of continued interest in Ethereum’s ecosystem and not merely short-term speculation.

Ethereum’s 17% increase in active addresses is a compelling development that points to the increasing adoption and use of the network. Whether the boost is related to DeFi activity, NFT sales, or market speculation, it solidifies Ethereum as a leading player in the blockchain arena.

If this is the case, we could see even greater bullish momentum for Ethereum in the weeks to come. The question on everyone’s mind—is this merely the start of a larger breakout for Ethereum?

Let us know what you think in the comments!

Stay Updated With the Latest Crypto News

For the latest updates, stay connected with us!

👉 Connect with us on LinkedIn: Latest Crypto Update

👉 Follow us on Instagram: Latest Crypto Update

👉 Follow us on Twitter: LCU on Twitter

👉 Subscribe to Our Newsletter for the latest crypto news and market insights.

Disclaimer:

The information provided on this website is for informational purposes only and may include third-party opinions or sponsored content. We do not offer financial advice. Before engaging with any exchange or individual, please conduct your own research and make decisions responsibly. For more details, review our Terms & Conditions.