Table of Contents Show

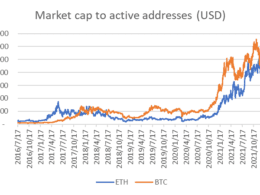

Ethereum (ETH) is at a crossroads as its price dropped by 11.5% over the last 24 hours, triggering fears of liquidations. At the center of this impending threat are three significant MakerDAO positions, each worth between $109 million and $126 million, that are at risk of liquidation if ETH’s decline persists.

Critical Liquidation Levels to Monitor

$1,926 – The initial key liquidation level.

$1,842 – A further decline might initiate additional forced selling.

$1,793 – If Ethereum hits this level, heavy liquidations will come into play.

These levels are the collateralization points of large MakerDAO vaults, so if the price of Ethereum falls below them, the liquidations will become automatic, adding to the selling pressure.

Market Impact and What’s Next

The cascading liquidations may cause increased volatility and a possible domino effect within the wider DeFi space. Traders and investors are watching ETH price action closely, with some taking defensive action such as adding collateral to prevent forced liquidations.

Ethereum’s rapid fall has led to huge liquidations looming and its price movement in the next few hours being critical. Should the bearish momentum continue, a major DeFi market shakeout may be in the works. Traders can expect higher volatility and potential trading opportunities as the market responds to these levels of importance.

Stay Updated With the Latest Crypto News

For the latest updates, stay connected with us!

👉 Connect with us on LinkedIn: Latest Crypto Update

👉 Follow us on Instagram: Latest Crypto Update

👉 Follow us on Twitter: LCU on Twitter

👉 Subscribe to Our Newsletter for the latest crypto news and market insights.

Disclaimer:

The information provided on this website is for informational purposes only and may include third-party opinions or sponsored content. We do not offer financial advice. Before engaging with any exchange or individual, please conduct your own research and make decisions responsibly. For more details, review our Terms & Conditions.

I’m extremely impressed together with your writing abilities as well as with the layout on your weblog. Is that this a paid subject or did you customize it yourself? Anyway keep up the excellent high quality writing, it is uncommon to peer a nice blog like this one today!